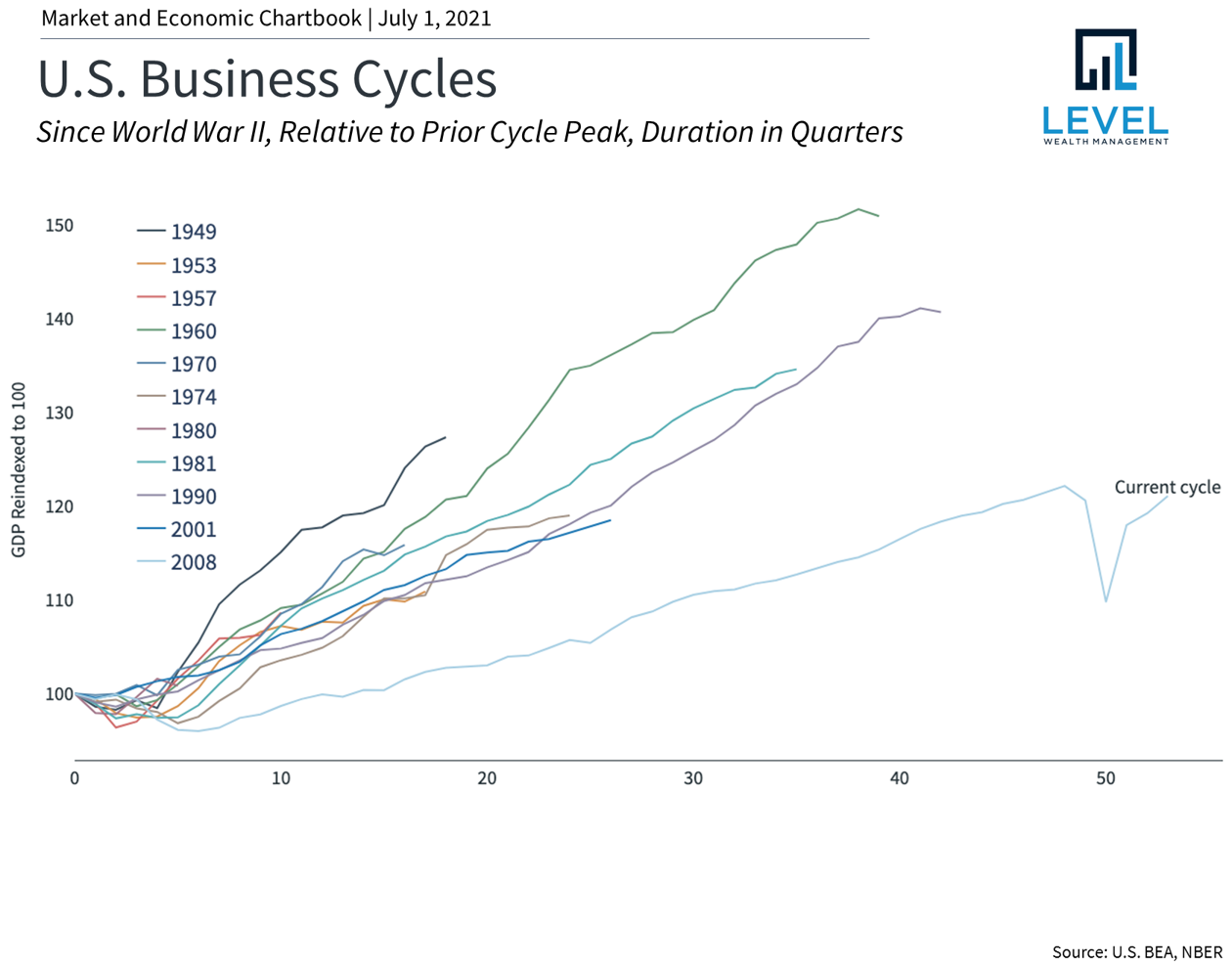

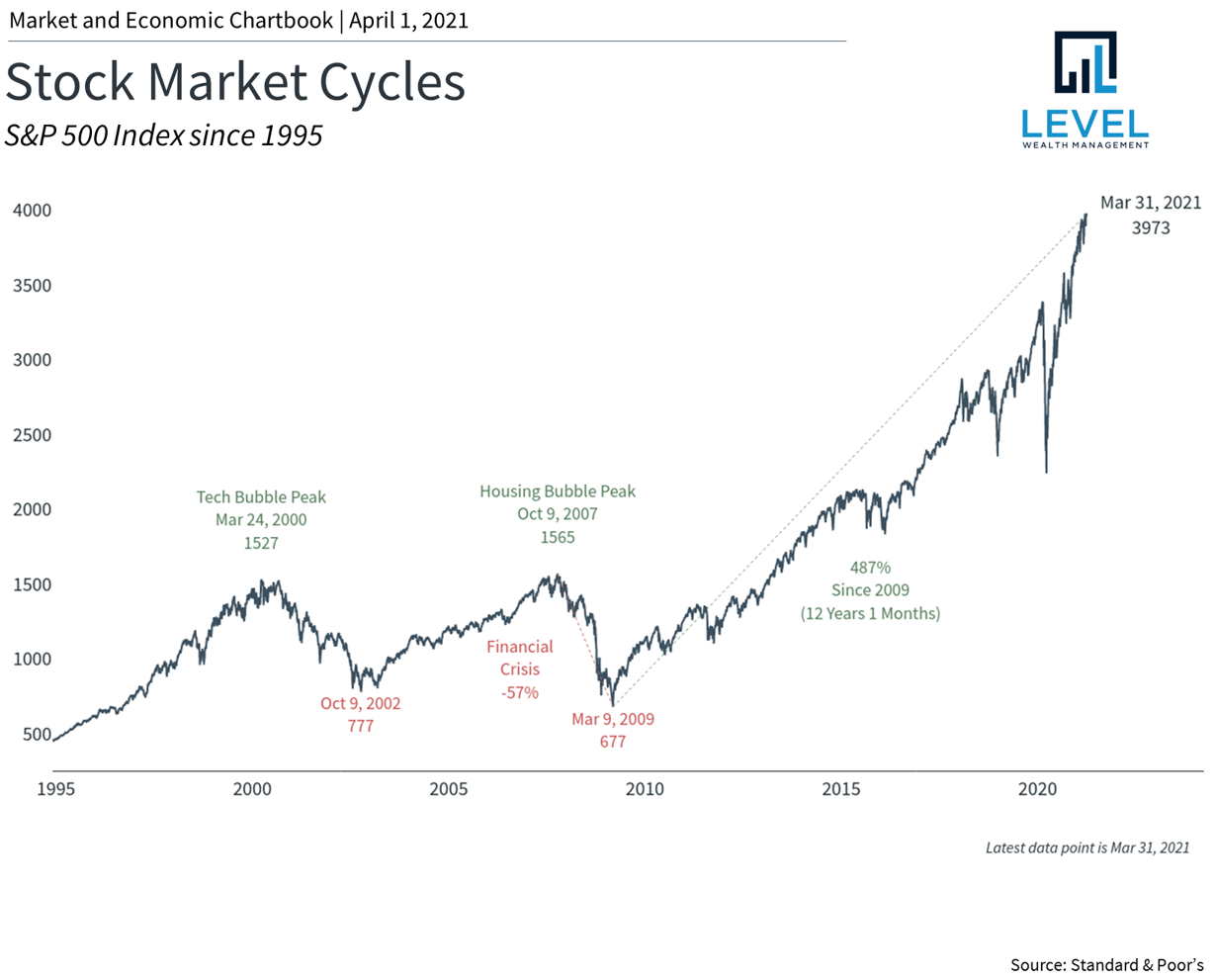

As we enter the second half of the year, investors continue to grapple with inflation, higher interest rates, the Fed, and the prospect of a recession. If historical bear markets are any indication, the decisions investors make during this period will have long-lasting effects on their portfolios. Resisting the temptation to overreact to daily market swings, dwelling on the past, and losing sight of bigger factors has never been more important. While it's difficult to imagine a market recovery today, more than a century of market history suggests that they can occur when investors least expect. Investors should consider what will matter to markets over the next several months as they position for the years and decades ahead.

Read MoreBlog

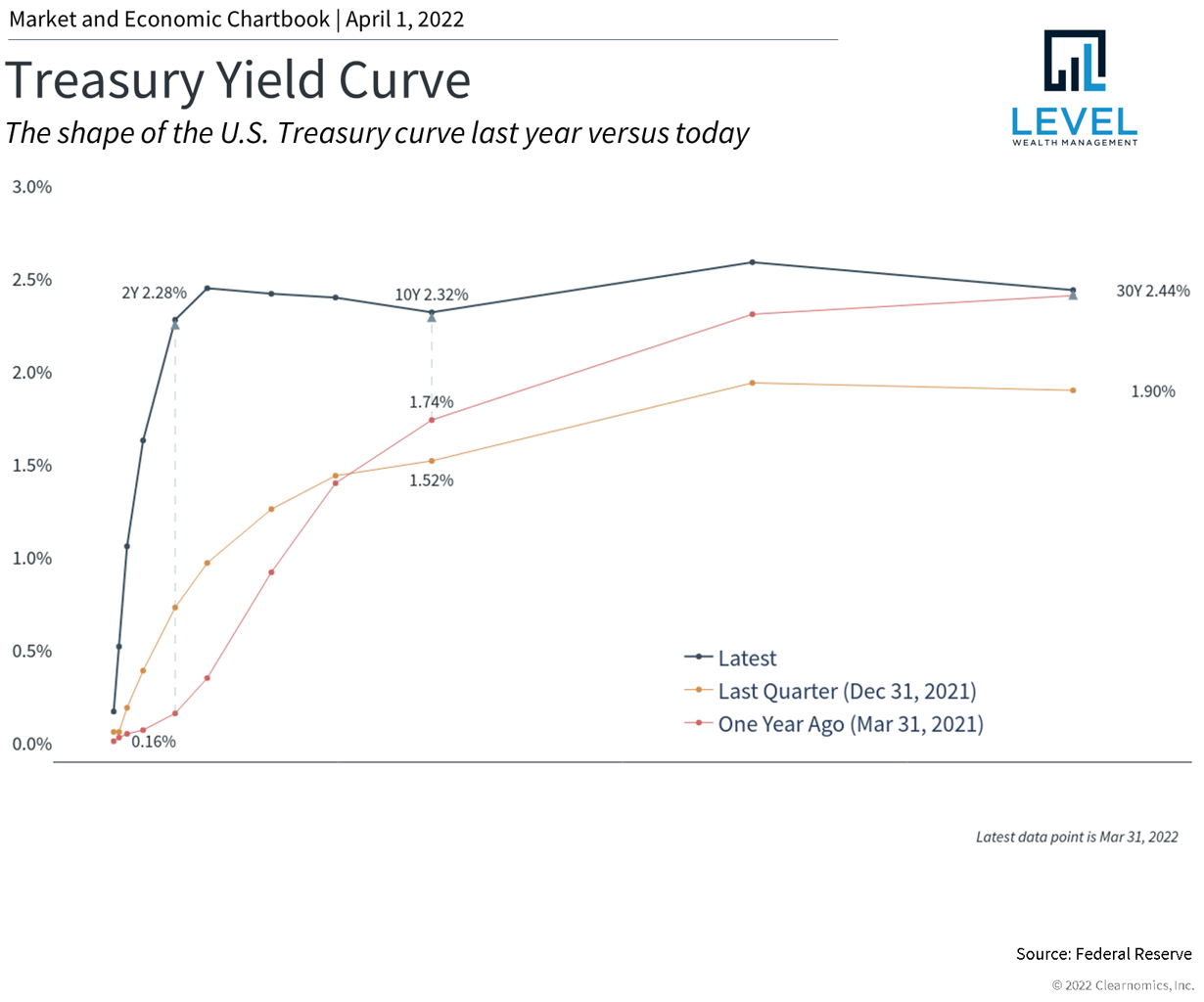

Investors faced historic challenges during the first quarter of the year as markets fell into correction territory. From red hot inflation to a Fed rate hike, Russia's invasion of Ukraine to rising oil prices, investors had to adjust to a rapidly changing environment. Year-to-date through March, the S&P 500 declined 5%, the Dow 4.6% and the Nasdaq 9.1%. Despite this, markets stabilized and bounced back during the final weeks of the quarter as more clarity emerged. Additionally, this period follows an exceptional two years of portfolio performance for diversified investors. How can long-term investors stay patient and focused throughout the rest of 2022 after a difficult start to the year?

Read More2021 has been a historic year for the economy and stock market. Economic activity is recovering at a once-in-a-lifetime pace as businesses expand and consumers spend. Financial markets are grinding higher with many major indices generating double-digit returns year-to-date, despite shifts in sector leadership. Inflation, which has been subdued for decades, is heating up. The pandemic rages on in parts of the world, but signs of recovery are spreading too. What can long-term investors learn from the past several months as they prepare for the second half of the year?

Read MoreGAME STOP, GAME STOP, GAME STOP…ok now that’s out of our system and we can all take a deep breath (while inhaling pollen) and enjoy the spring sunshine. The first quarter of this year brought more challenges but also a renewed sense of hope that things are beginning to look up in this crazy world we are living in. As for my family, we have enjoyed seeing the faces of our friends and neighbors as the temperatures are getting warmer. We hope you all enjoyed the holiday weekend!

Read MoreWelcome to 2021! I think we can all agree that 2020 was an unexpected mess and we are thankful to see a new year. As a family, we did a lot of reflecting over the holidays. Our consensus was that we are simply grateful for each other, our health, and our good fortune. We know that so many faced great challenges during 2020. I hope that we can all find ways to hold on to that gratitude and cherish the little things well into 2021.

Read MoreSummer came to a screeching halt this year as the cooler weather came quickly. In our house it brought with it a refreshing sense of gratitude for another season in what feels like a VERY LONG YEAR. October is a big month in our home. We have Bradford and Dottie’s birthdays, Halloween and then we get right into the holiday spirit. We are going into this season thankful for our health and for yours!

Read MoreAs 2020 continues to prove, life is anything but certain. The only thing you can control is how you react or adapt to that uncertainty. Mid conversation with my 6-year-old Bradford, I realized just how quickly we can adapt.

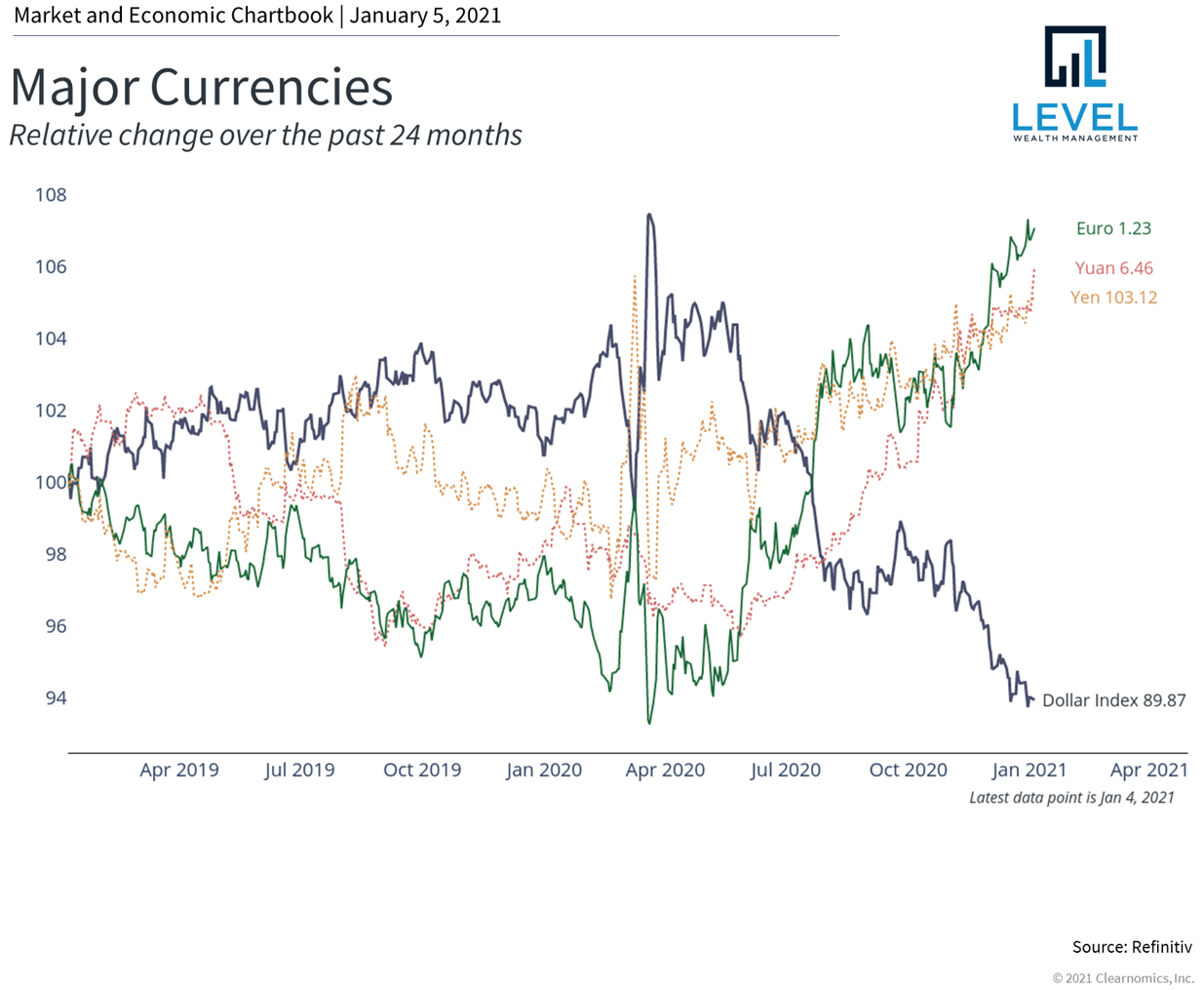

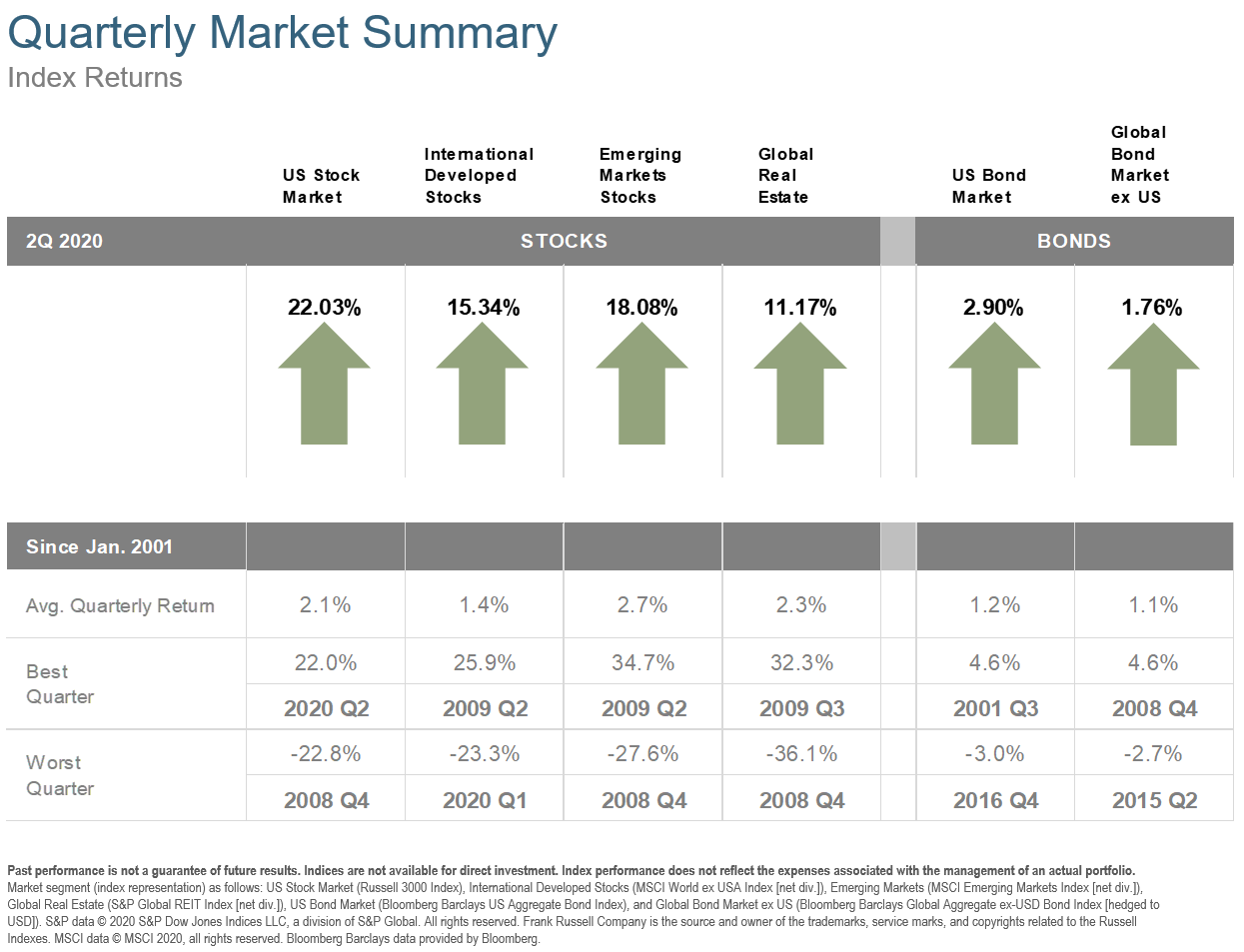

Read More2019 was a great year for all asset classes. US stocks continue to be the best performer earning 31.02%. Global Real Estate was the second-best performer earning 23.12%. International Developed and Emerging Market stocks still had a great year earning 22.49% and 18.42% respectively. Interest rates increased slightly in the 4th quarter which kept bond performance flat during that time period. For the year though, interest rates decreased. This had a positive impact on bond performance with the US bond market earning 8.72% and international bonds earning 7.57%.

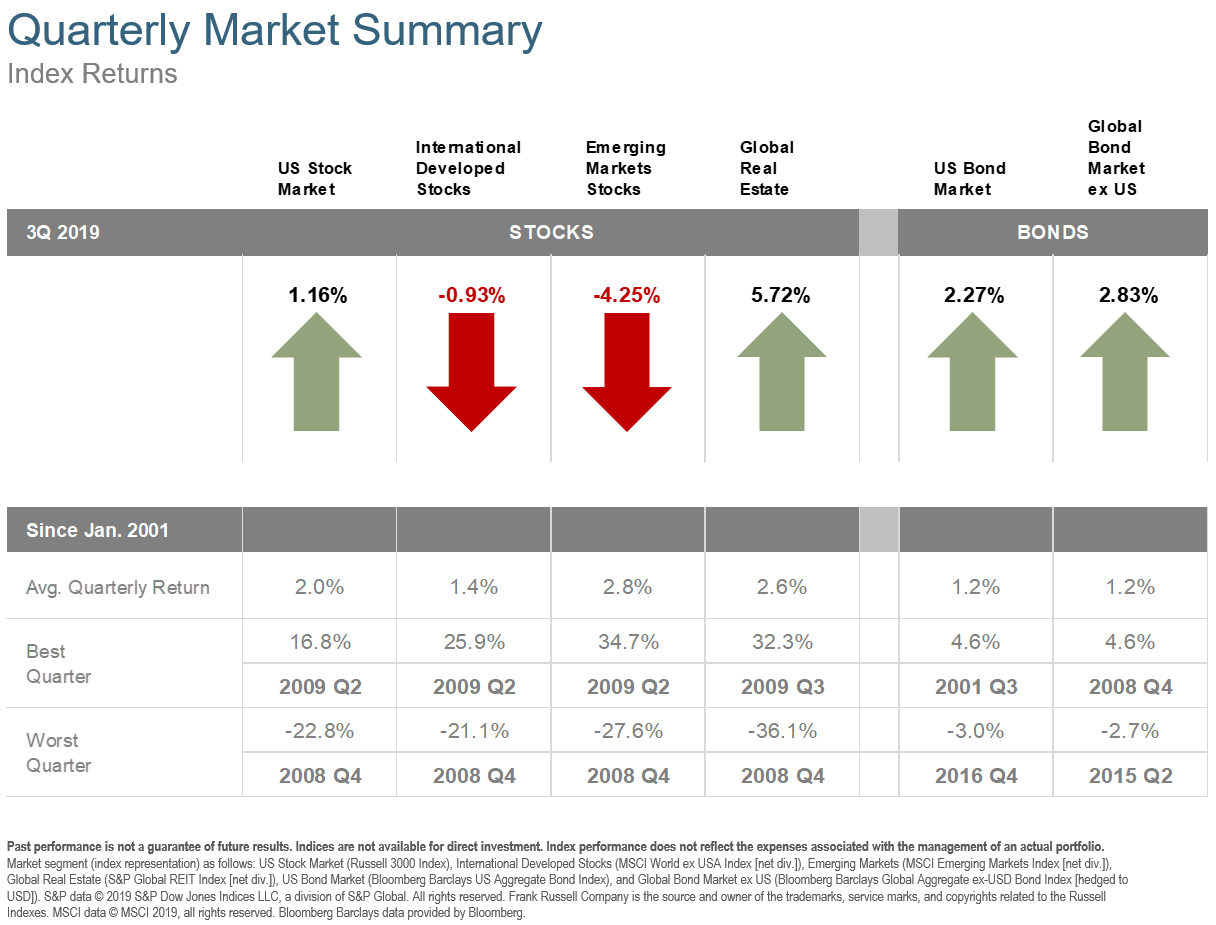

Read MoreThe third quarter had no shortage of big headlines but not much has fundamentally changed. U.S. stock performance was slightly positive, while international developed markets were slightly negative. Emerging markets and global real estate had larger swings with the former down over 4% and the latter up almost 6%. With interest rates continuing their decline, U.S. and global bonds both performed well this past quarter.

Read MoreThe end of the second quarter marked the best first half performance in 22 years for the S&P 500. The index reached multiple new highs making up for the losses experienced in the fourth quarter of last year. The US economy grew at an annualized rate of 3.1% in the first quarter, but economist expect that growth to slow in the second quarter. Unemployment remains low at 3.7% and inflation has continued to hover around 2%. While the stock market’s performance and the economy’s slow but steady growth is great news, there are always a few reasons to be cautious.

Read MoreLast week, US stocks briefly reached a record high and 10-year government bonds (U.S. Treasuries) briefly dipped below 2%. That yield is close to the historical low of 1.35% reached in 2016. If you are approaching retirement, what are you to do? Stocks are near all-time highs, but government bonds are only paying you approximately 2%. Keep in mind that 2% is gross of any fund or advisor fees. One thing to consider is optimizing your fixed income.

Read More