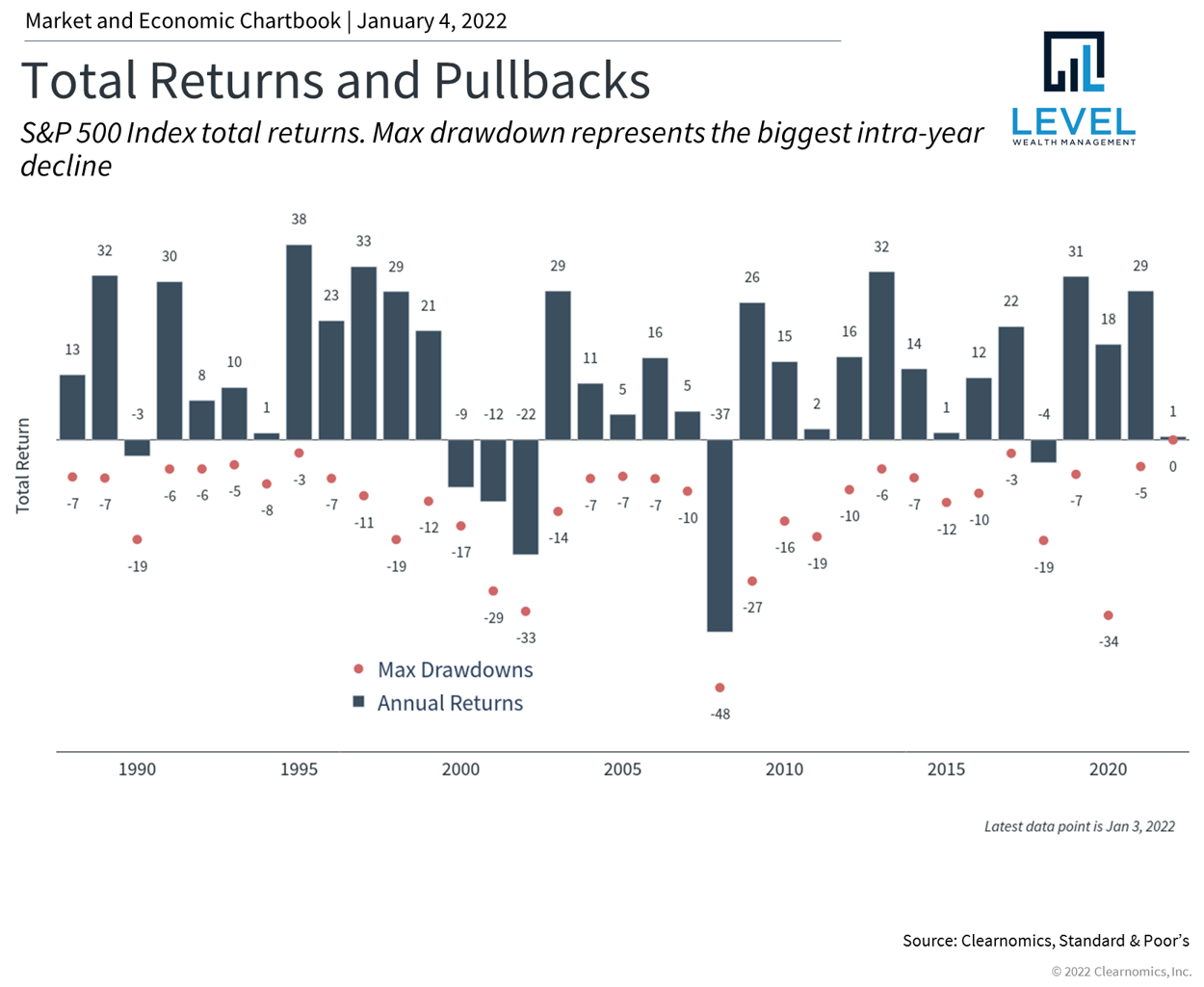

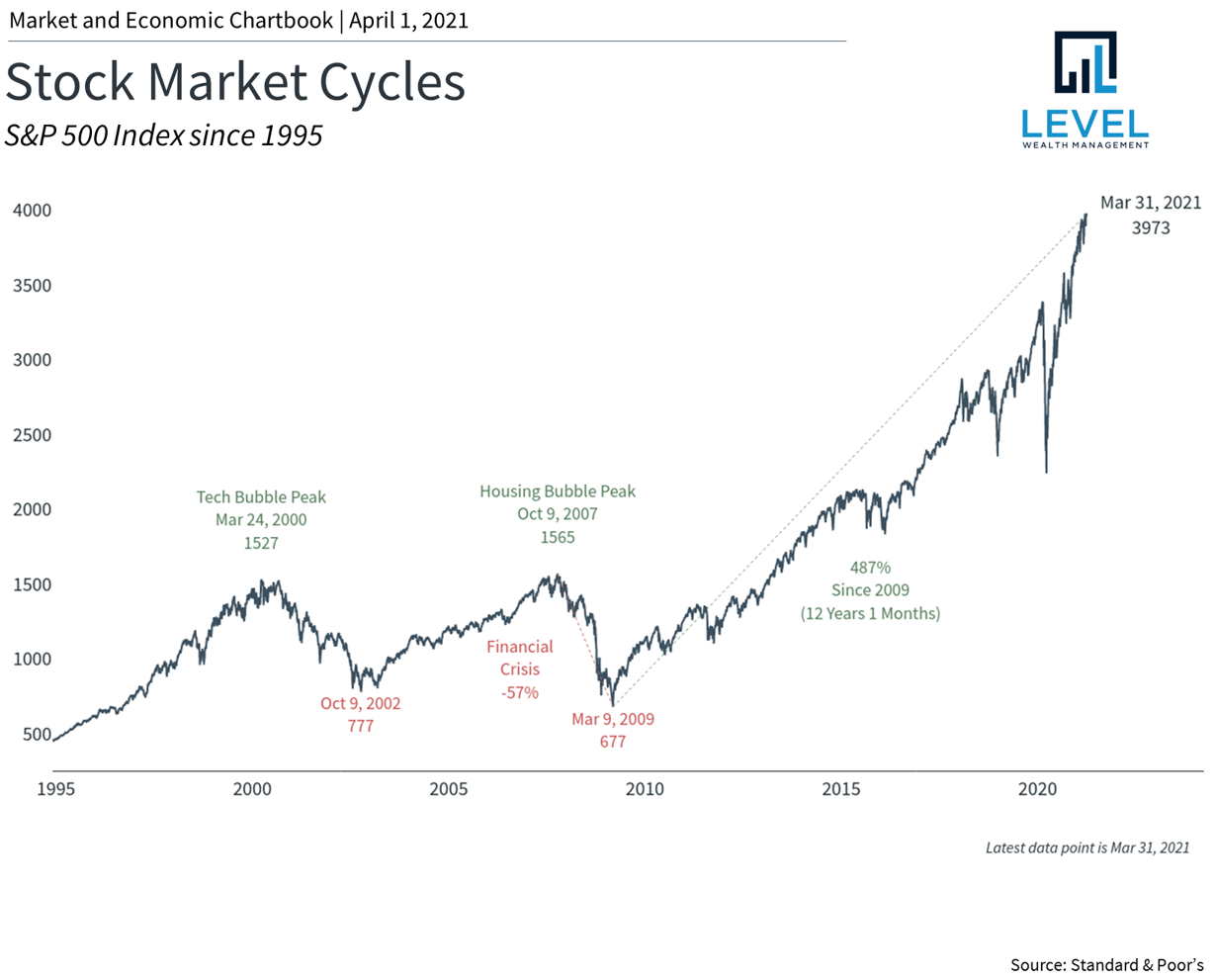

The famous investor Peter Lynch once wrote that "far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” The topic of stock market corrections, defined as declines of 10% or more from all-time highs, rose to the forefront in the first quarter as major market indices stumbled. However, as Lynch’s quote suggests, taking a longer perspective reveals that despite recent swings, the stock market has still made significant gains over the past few years. Amid ongoing market and economic uncertainty, it’s important for long-term investors to not lose sight of this fact.

Read MoreBlog

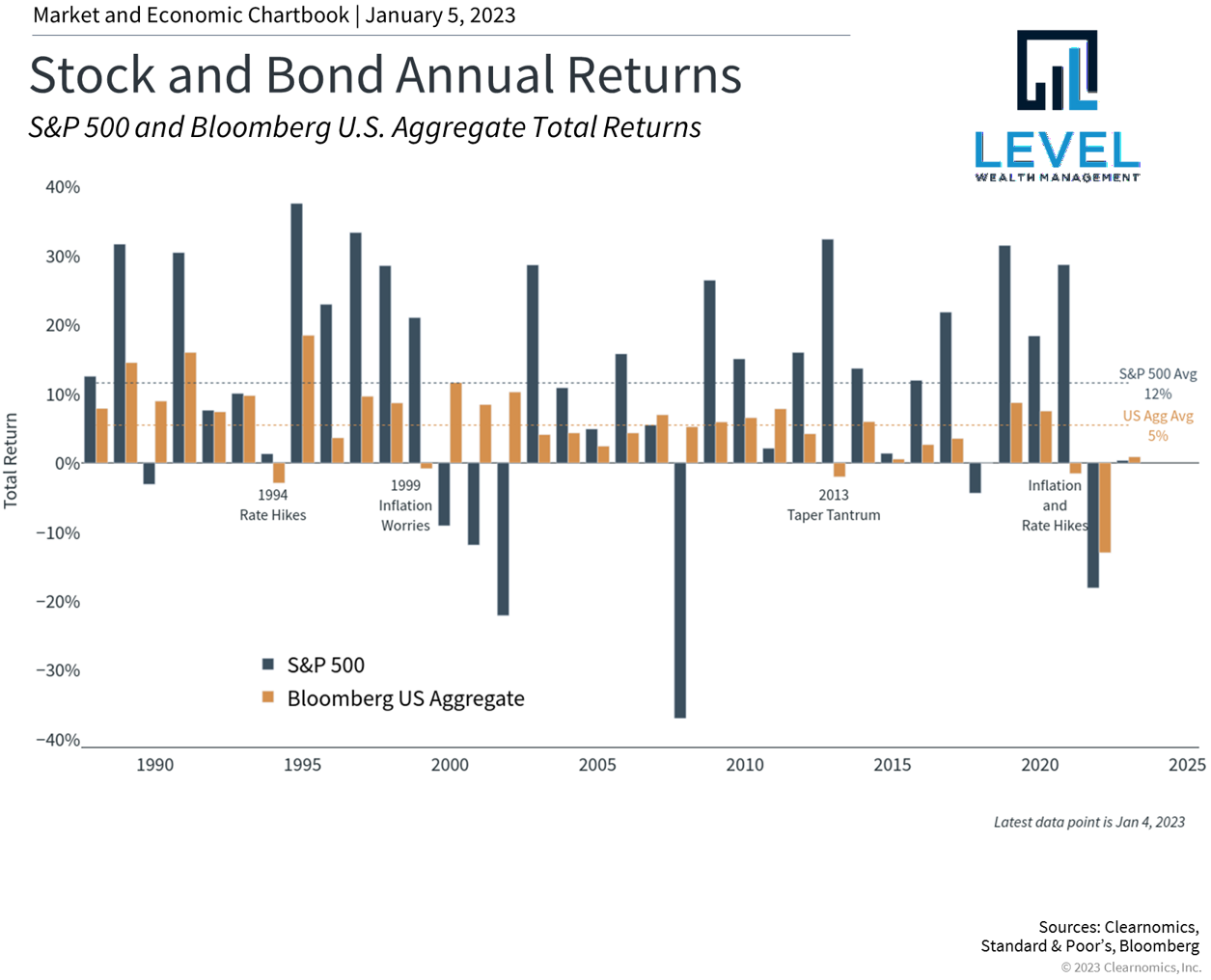

2024 was a year of unexpectedly strong market performance. Major stock market indices generated historic gains with the S&P 500 returning 25.0% with dividends, the Nasdaq 29.6%, and the Dow Jones Industrial Average 15.0%. This occurred despite concerns around inflation, recessions, Fed policy, and the presidential election. International stocks also performed well with emerging markets rising 8.1% and developed market stocks gaining 4.3%.

Read MoreAs we begin the final quarter of 2024, financial markets and the economy have defied the expectations of many investors. Rather than falling into recession, the economy has grown steadily, albeit at a slower pace, and inflation rates have fallen toward the Fed’s target. As a result, the macroeconomic environment has shifted to a monetary easing cycle, propelling the S&P 500 and Dow Jones Industrial Average to new all-time highs and boosting bond returns. The first three quarters of the year are a reminder that it’s often best to focus on the longer-term trends rather than events in the rearview mirror.

Read More2024 began with debates over a “soft” versus “hard” landing as the Fed attempted to stabilize the economy as well as over the sustainability of last year’s market rally. Only three months later, those concerns have given way to a calmer environment centered around fading inflation and the Fed’s plans for reducing interest rates. This has resulted in a strong market rally with the S&P 500 index, Dow Jones Industrial Average, and Nasdaq gaining 10.2%, 5.6%, and 9.1% year-to-date, respectively.

Read More2023 marked an inflection point for markets with strong gains across both stocks and bonds. The S&P 500, Dow, and Nasdaq generated exceptional returns of 26.3%, 16.2%, and 44.7% with reinvested dividends last year, respectively. The S&P has come full circle and is now only a fraction of a percentage point below the all-time high from exactly two years ago. The U.S. 10-Year Treasury yield climbed as high as 5% in October before falling to end the year around 3.9%, pushing bond prices higher in the process. International stocks also performed well with developed markets returning 18.9% and emerging markets 10.3%.

Read MoreAs the final quarter of the year begins, markets are grappling with rising interest rates and continued economic uncertainty. These factors led the S&P 500 to decline 3.3% (with reinvested dividends) during the third quarter while the U.S. Aggregate bond index lost 3.2%. On the surface, these issues echo the many concerns that investors faced last year when inflation and higher rates resulted in a bear market. Other factors including the narrowly averted government shutdown and cracks in China's economy have also added to investor fears. Amid the seemingly constant stream of negative headlines, how can long-term investors stay positive as they prepare for the final months of the year?

Read MoreDrew Cook, CFP® is a Charlotte, NC fee-only financial planner. He joined Level Wealth Management because of his shared priorities to always serve clients as a fiduciary and to let financial planning drive fees instead of an account balance.

Read MoreMajor stock market indices made significant gains in the first half of the year due to improving inflation, slowing Fed rate hikes, the absence of a recession, a more stable banking sector, and a strong rally in tech stocks. The S&P 500 has climbed 16.9% with reinvested dividends this year, while the Nasdaq and Dow have returned 32.3% and 4.9%, respectively.

Read MoreIn times of market uncertainty, investors often turn to sayings such as "those who fail to learn from history are doomed to repeat it" and "history never repeats itself, but it does often rhyme." When it comes to the day-to-day headlines, both quotes are relevant given the long history of banking crises and market swings.

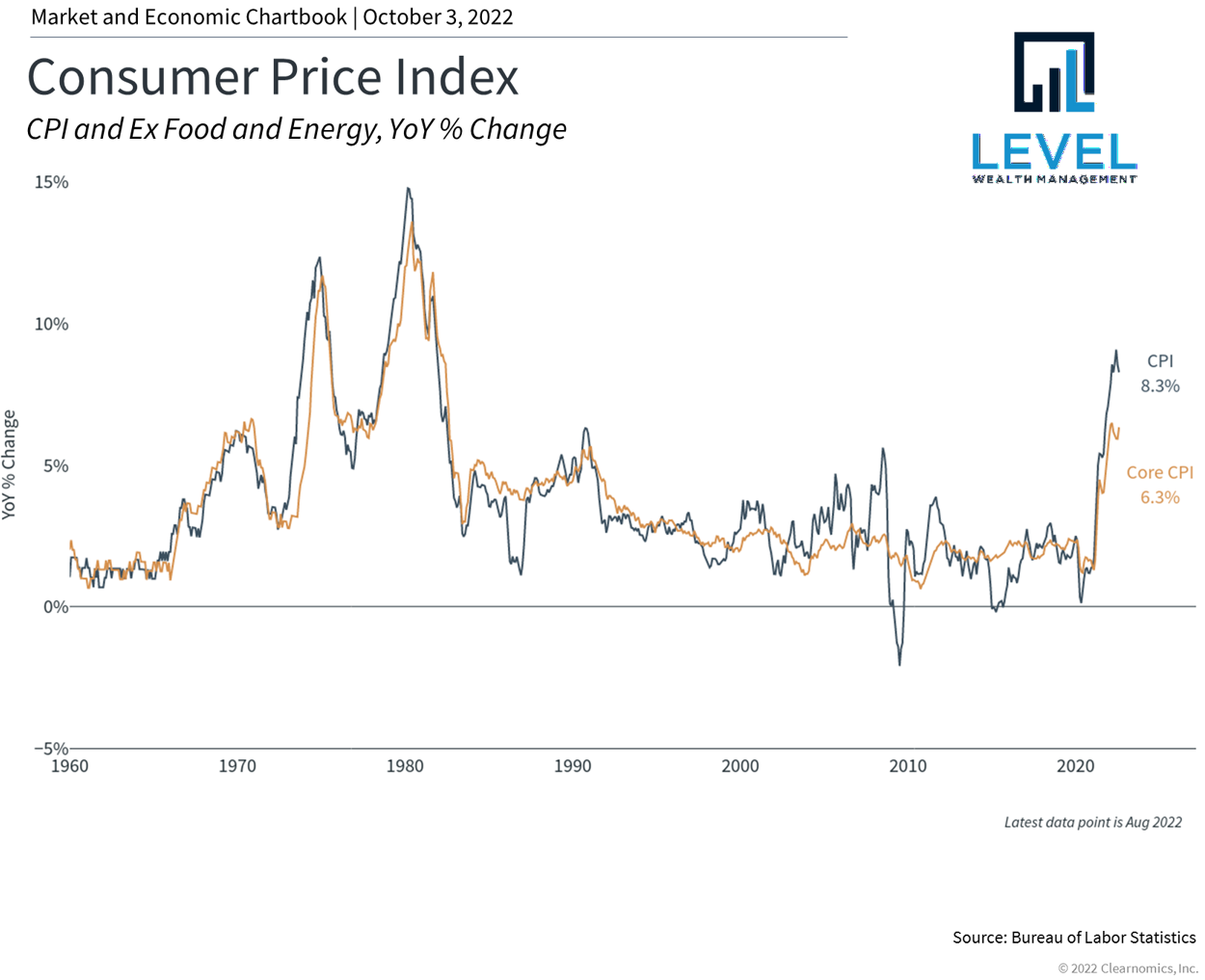

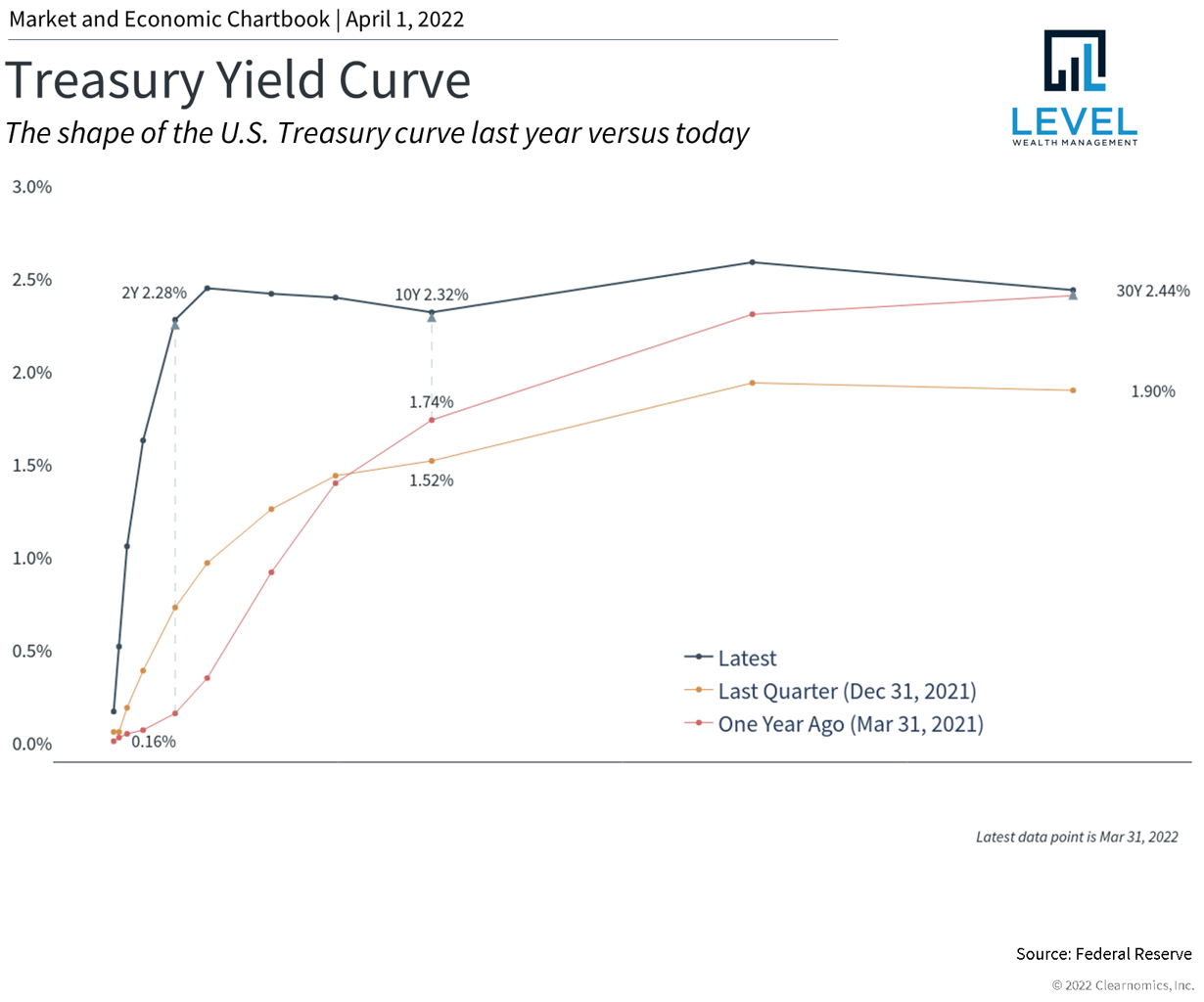

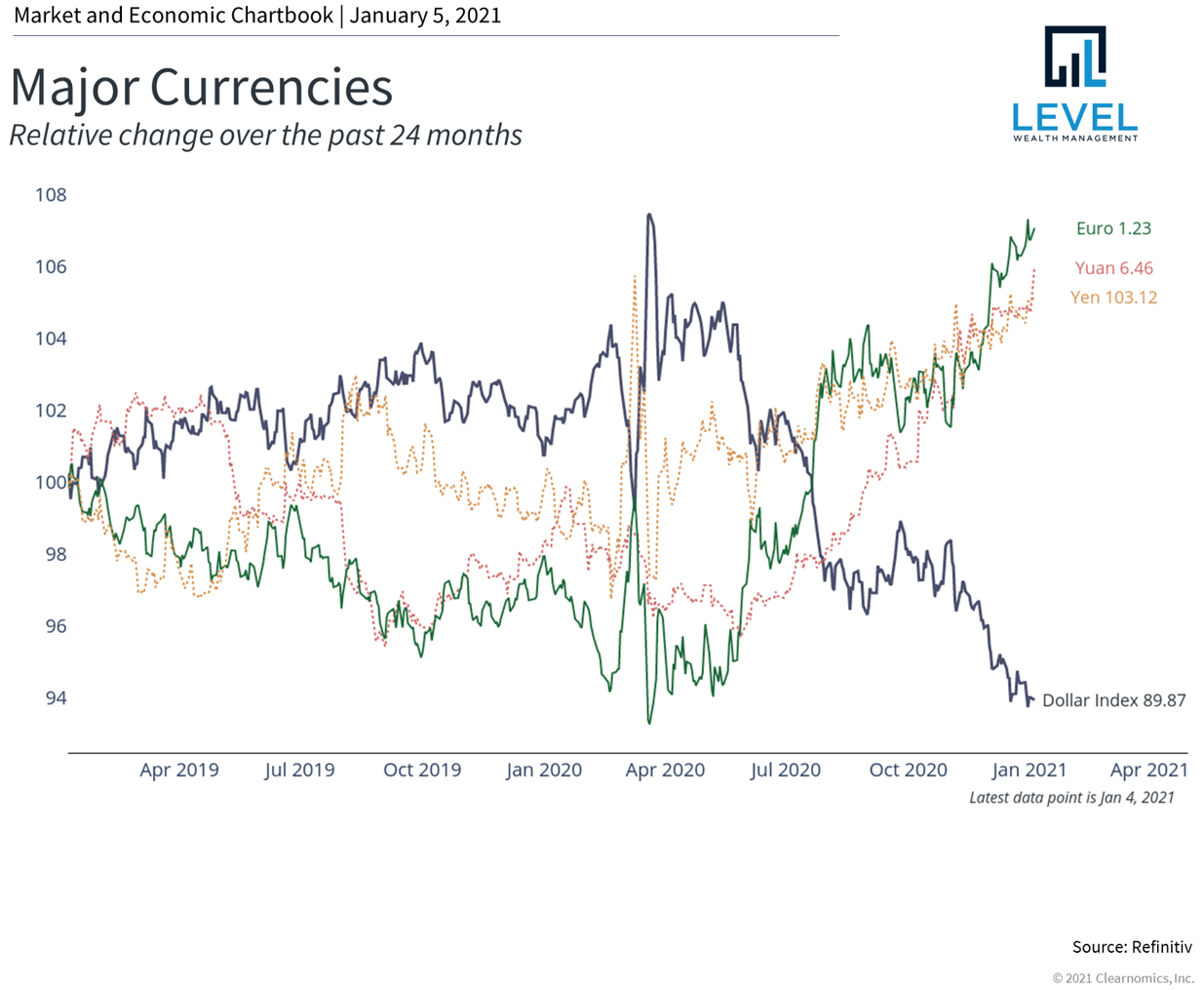

Read More2022 was a challenging year for investors. Markets fell into bear market territory and experienced the worst annual performance since 2008. The S&P 500, Dow and Nasdaq declined 19.4%, 8.8% and 33.1%, respectively, last year. Interest rates swung wildly with the 10-year Treasury yield jumping from 1.51% at the start of the year to a high of 4.24%, before ending at 3.88%. This mirrored inflation as the Consumer Price Index climbed to a 40-year high of 9.1% in September. As a result, the Fed hiked rates seven consecutive times from 0% last March to 4.25% in December. Along the way, a multitude of other events impacted markets from the war in Ukraine to China's zero-Covid policy, affecting everything from oil prices to the U.S. dollar.

Read MoreInvestors have navigated a difficult market all year and the third quarter was no exception. All major indices ended the quarter in bear market territory with the S&P 500, Dow and Nasdaq declining 5.3%, 6.7%, and 4.1%, respectively, from July to September. With the dollar strengthening and the global economy slowing, the MSCI EAFE index of international developed markets fell 10% over the same period in dollar terms, while the MSCI EM index of emerging markets pulled back 12.5%. Interest rates jumped with the 10-year Treasury yield climbing above 4% on an intra-day basis, the highest level since 2008. The challenges of persistently high inflation and slowing growth have continued to impact the expectations of both investors and policymakers.

Read MoreAs we enter the second half of the year, investors continue to grapple with inflation, higher interest rates, the Fed, and the prospect of a recession. If historical bear markets are any indication, the decisions investors make during this period will have long-lasting effects on their portfolios. Resisting the temptation to overreact to daily market swings, dwelling on the past, and losing sight of bigger factors has never been more important. While it's difficult to imagine a market recovery today, more than a century of market history suggests that they can occur when investors least expect. Investors should consider what will matter to markets over the next several months as they position for the years and decades ahead.

Read MoreInvestors faced historic challenges during the first quarter of the year as markets fell into correction territory. From red hot inflation to a Fed rate hike, Russia's invasion of Ukraine to rising oil prices, investors had to adjust to a rapidly changing environment. Year-to-date through March, the S&P 500 declined 5%, the Dow 4.6% and the Nasdaq 9.1%. Despite this, markets stabilized and bounced back during the final weeks of the quarter as more clarity emerged. Additionally, this period follows an exceptional two years of portfolio performance for diversified investors. How can long-term investors stay patient and focused throughout the rest of 2022 after a difficult start to the year?

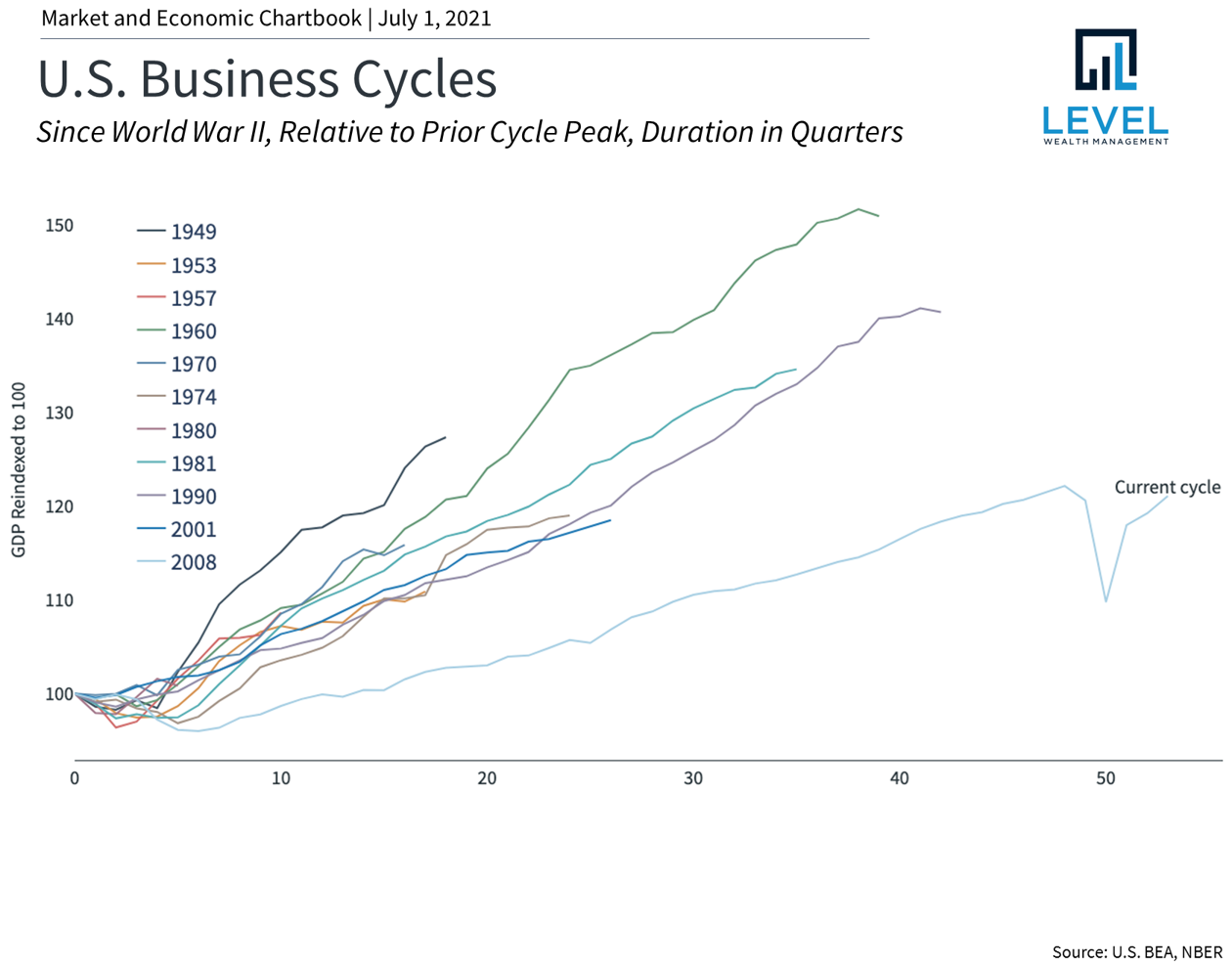

Read MoreWelcome to 2022! With the ups and downs of the market and the on-going pandemic, the fact that we are approaching the third year of the business cycle may surprise some investors. After the headlines of the past year, one might expect that the market would have struggled. Events during this period include the attack on the U.S. Capitol, the delta and omicron variants, the foreign policy disaster in Afghanistan, Fed tapering, challenges passing new fiscal bills, reddit trades, the rise of cryptocurrencies, China's bursting housing bubble, inflation at multi-decade highs, supply chain disruptions, and many more. As in most years, there was no shortage of reasons to be pessimistic in 2021.

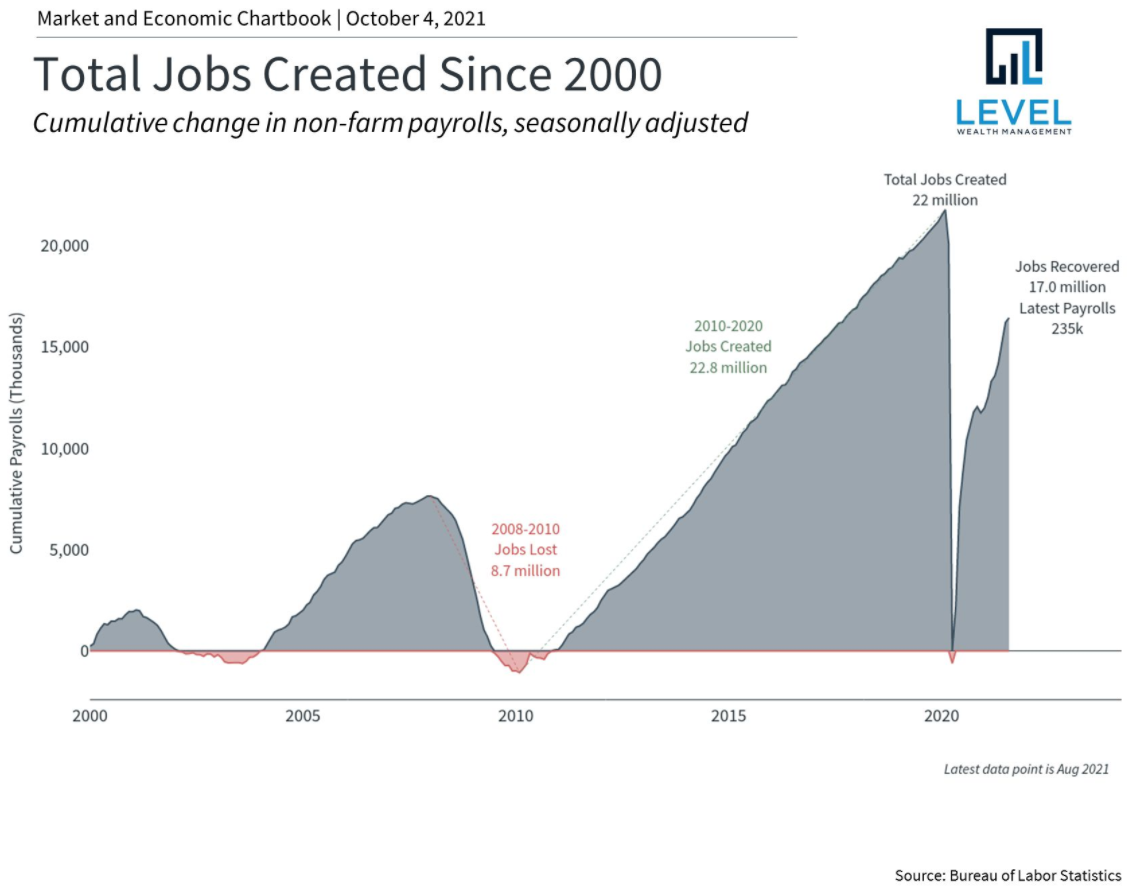

Read MoreAs we begin the final quarter of 2021, the economy is shifting from a recovery phase to a sustained expansion. Investor sentiment has shifted alongside this, swinging from bullishness to bearishness. This is understandable because, while the underlying trends are positive, it's no longer the case that the economy and markets have nowhere to go but up. Challenges such as the pace of growth, fears of stagflation, debt problems in China, Fed policy, the government debt ceiling and more are weighing on investors' minds. How can investors balance risk and reward with a long-term perspective during the final months of the year?

Read More2021 has been a historic year for the economy and stock market. Economic activity is recovering at a once-in-a-lifetime pace as businesses expand and consumers spend. Financial markets are grinding higher with many major indices generating double-digit returns year-to-date, despite shifts in sector leadership. Inflation, which has been subdued for decades, is heating up. The pandemic rages on in parts of the world, but signs of recovery are spreading too. What can long-term investors learn from the past several months as they prepare for the second half of the year?

Read MoreGAME STOP, GAME STOP, GAME STOP…ok now that’s out of our system and we can all take a deep breath (while inhaling pollen) and enjoy the spring sunshine. The first quarter of this year brought more challenges but also a renewed sense of hope that things are beginning to look up in this crazy world we are living in. As for my family, we have enjoyed seeing the faces of our friends and neighbors as the temperatures are getting warmer. We hope you all enjoyed the holiday weekend!

Read MoreWelcome to 2021! I think we can all agree that 2020 was an unexpected mess and we are thankful to see a new year. As a family, we did a lot of reflecting over the holidays. Our consensus was that we are simply grateful for each other, our health, and our good fortune. We know that so many faced great challenges during 2020. I hope that we can all find ways to hold on to that gratitude and cherish the little things well into 2021.

Read MoreSummer came to a screeching halt this year as the cooler weather came quickly. In our house it brought with it a refreshing sense of gratitude for another season in what feels like a VERY LONG YEAR. October is a big month in our home. We have Bradford and Dottie’s birthdays, Halloween and then we get right into the holiday spirit. We are going into this season thankful for our health and for yours!

Read MoreAs 2020 continues to prove, life is anything but certain. The only thing you can control is how you react or adapt to that uncertainty. Mid conversation with my 6-year-old Bradford, I realized just how quickly we can adapt.

Read More