As we enter the second half of the year, investors continue to grapple with inflation, higher interest rates, the Fed, and the prospect of a recession. If historical bear markets are any indication, the decisions investors make during this period will have long-lasting effects on their portfolios. Resisting the temptation to overreact to daily market swings, dwelling on the past, and losing sight of bigger factors has never been more important. While it's difficult to imagine a market recovery today, more than a century of market history suggests that they can occur when investors least expect. Investors should consider what will matter to markets over the next several months as they position for the years and decades ahead.

Read MoreBlog

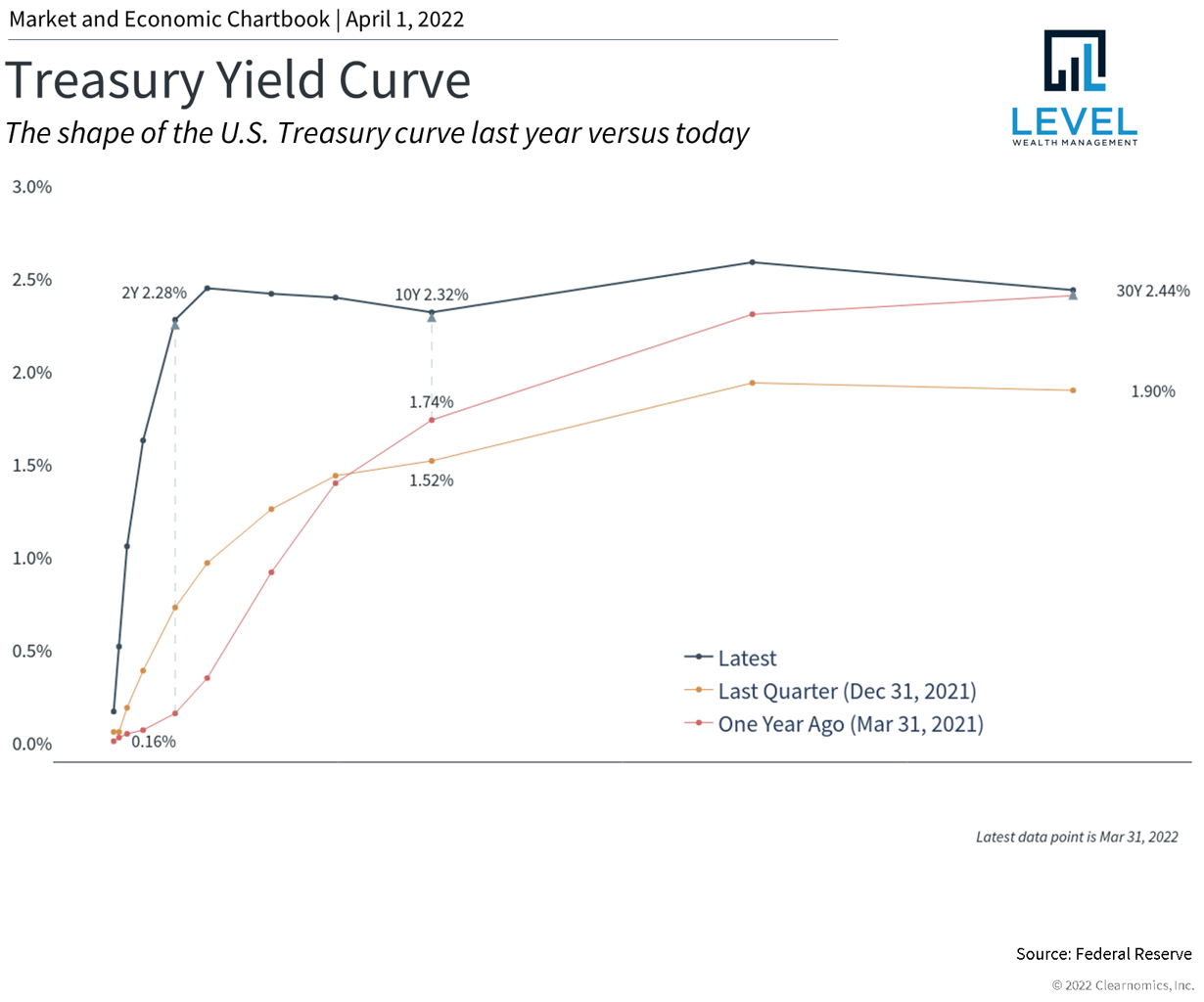

Investors faced historic challenges during the first quarter of the year as markets fell into correction territory. From red hot inflation to a Fed rate hike, Russia's invasion of Ukraine to rising oil prices, investors had to adjust to a rapidly changing environment. Year-to-date through March, the S&P 500 declined 5%, the Dow 4.6% and the Nasdaq 9.1%. Despite this, markets stabilized and bounced back during the final weeks of the quarter as more clarity emerged. Additionally, this period follows an exceptional two years of portfolio performance for diversified investors. How can long-term investors stay patient and focused throughout the rest of 2022 after a difficult start to the year?

Read More