2019 was a great year for all asset classes. US stocks continue to be the best performer earning 31.02%. Global Real Estate was the second-best performer earning 23.12%. International Developed and Emerging Market stocks still had a great year earning 22.49% and 18.42% respectively. Interest rates increased slightly in the 4th quarter which kept bond performance flat during that time period. For the year though, interest rates decreased. This had a positive impact on bond performance with the US bond market earning 8.72% and international bonds earning 7.57%.

Read MoreBlog

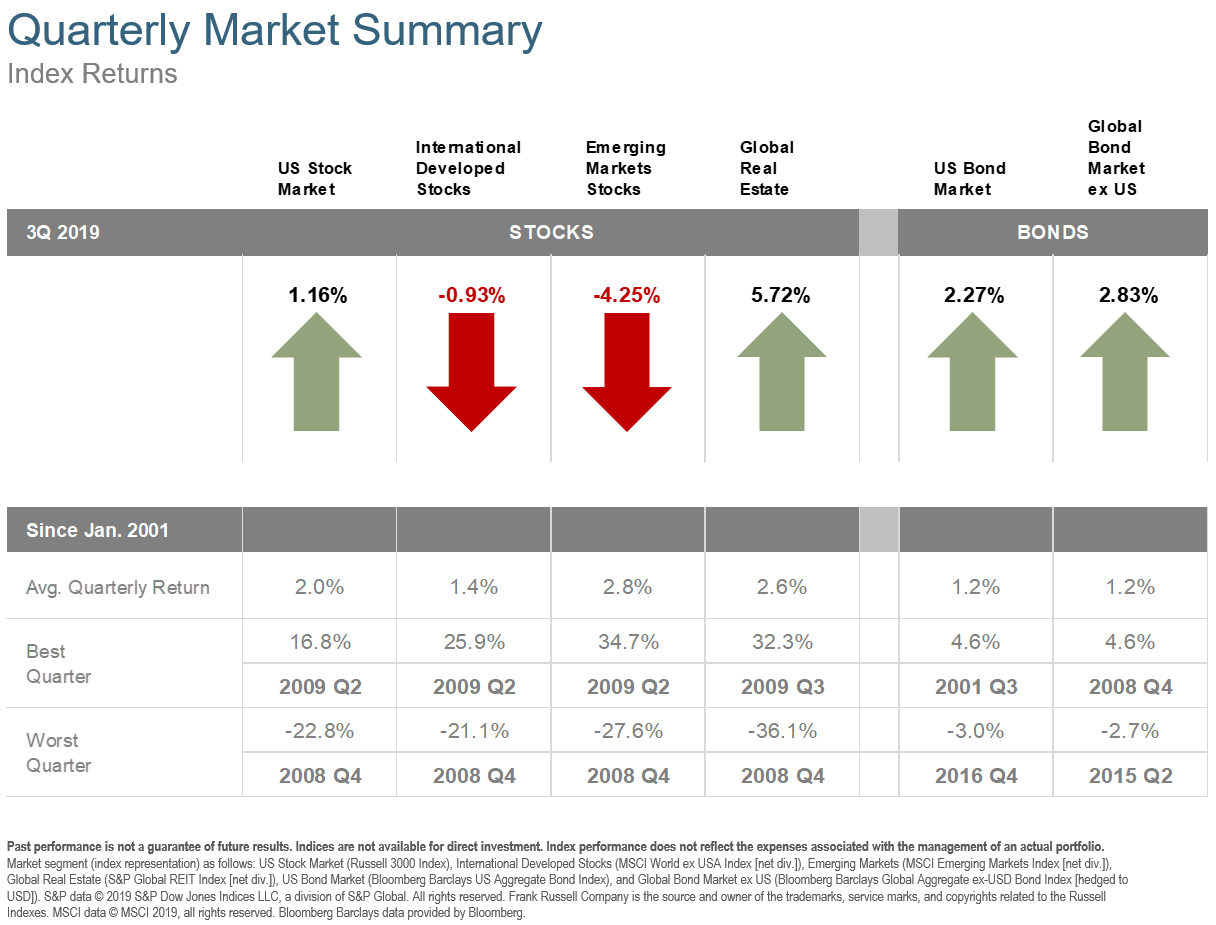

The third quarter had no shortage of big headlines but not much has fundamentally changed. U.S. stock performance was slightly positive, while international developed markets were slightly negative. Emerging markets and global real estate had larger swings with the former down over 4% and the latter up almost 6%. With interest rates continuing their decline, U.S. and global bonds both performed well this past quarter.

Read MoreThe distribution phase of retirement can be significantly more complex than the accumulation phase leading up to it. In the accumulation phase, you are contributing to accounts and buying investments. In the distribution phase, you are selling investments and distributing money from accounts. The latter two events typically trigger taxes which adds an additional layer of complexity to your finances.

Read MoreThe end of the second quarter marked the best first half performance in 22 years for the S&P 500. The index reached multiple new highs making up for the losses experienced in the fourth quarter of last year. The US economy grew at an annualized rate of 3.1% in the first quarter, but economist expect that growth to slow in the second quarter. Unemployment remains low at 3.7% and inflation has continued to hover around 2%. While the stock market’s performance and the economy’s slow but steady growth is great news, there are always a few reasons to be cautious.

Read MoreLast week, US stocks briefly reached a record high and 10-year government bonds (U.S. Treasuries) briefly dipped below 2%. That yield is close to the historical low of 1.35% reached in 2016. If you are approaching retirement, what are you to do? Stocks are near all-time highs, but government bonds are only paying you approximately 2%. Keep in mind that 2% is gross of any fund or advisor fees. One thing to consider is optimizing your fixed income.

Read More