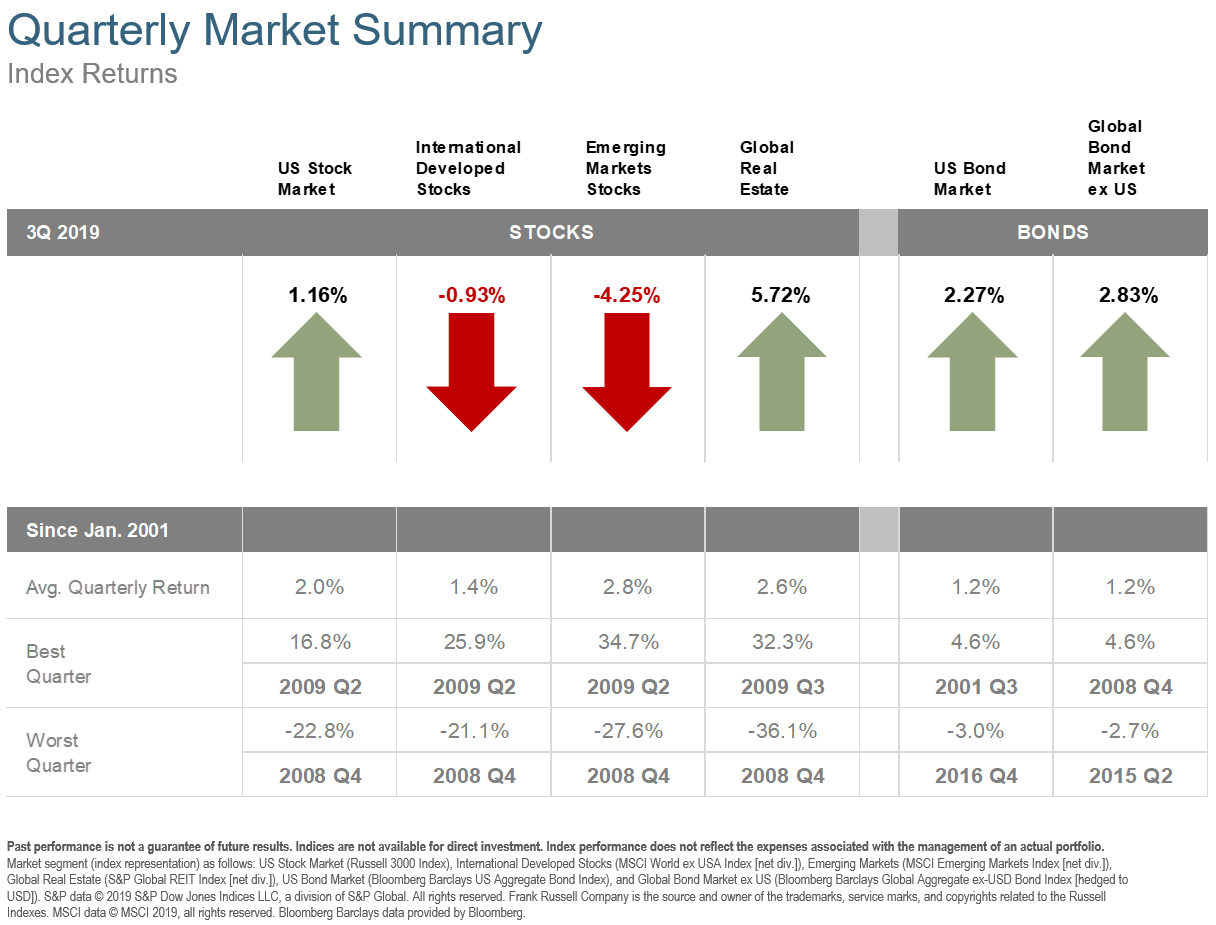

The third quarter had no shortage of big headlines but not much has fundamentally changed. U.S. stock performance was slightly positive, while international developed markets were slightly negative. Emerging markets and global real estate had larger swings with the former down over 4% and the latter up almost 6%. With interest rates continuing their decline, U.S. and global bonds both performed well this past quarter.

Read MoreBlog

The distribution phase of retirement can be significantly more complex than the accumulation phase leading up to it. In the accumulation phase, you are contributing to accounts and buying investments. In the distribution phase, you are selling investments and distributing money from accounts. The latter two events typically trigger taxes which adds an additional layer of complexity to your finances.

Read MoreThe end of the second quarter marked the best first half performance in 22 years for the S&P 500. The index reached multiple new highs making up for the losses experienced in the fourth quarter of last year. The US economy grew at an annualized rate of 3.1% in the first quarter, but economist expect that growth to slow in the second quarter. Unemployment remains low at 3.7% and inflation has continued to hover around 2%. While the stock market’s performance and the economy’s slow but steady growth is great news, there are always a few reasons to be cautious.

Read MoreLast week, US stocks briefly reached a record high and 10-year government bonds (U.S. Treasuries) briefly dipped below 2%. That yield is close to the historical low of 1.35% reached in 2016. If you are approaching retirement, what are you to do? Stocks are near all-time highs, but government bonds are only paying you approximately 2%. Keep in mind that 2% is gross of any fund or advisor fees. One thing to consider is optimizing your fixed income.

Read MoreJason Zweig of the Wall Street Journal wrote an article in 2017 about questions to ask your financial advisor. It has some great nuggets to ask any advisor you are considering working with. I wrote my answers below but you can read Jason’s full article along with his suggested answers here.

Read MoreAs a new entrepreneur, I find myself getting stuck in all the specifics and details of making everything perfect. Making sure the software is working as expected, confirming compliance and creating workflows. It’s almost the middle of May now and I have been going at this nonstop since March 5th. I’m taking a little break from the business details to share WHY I decided to take the leap and start Level Wealth Management.

Read More